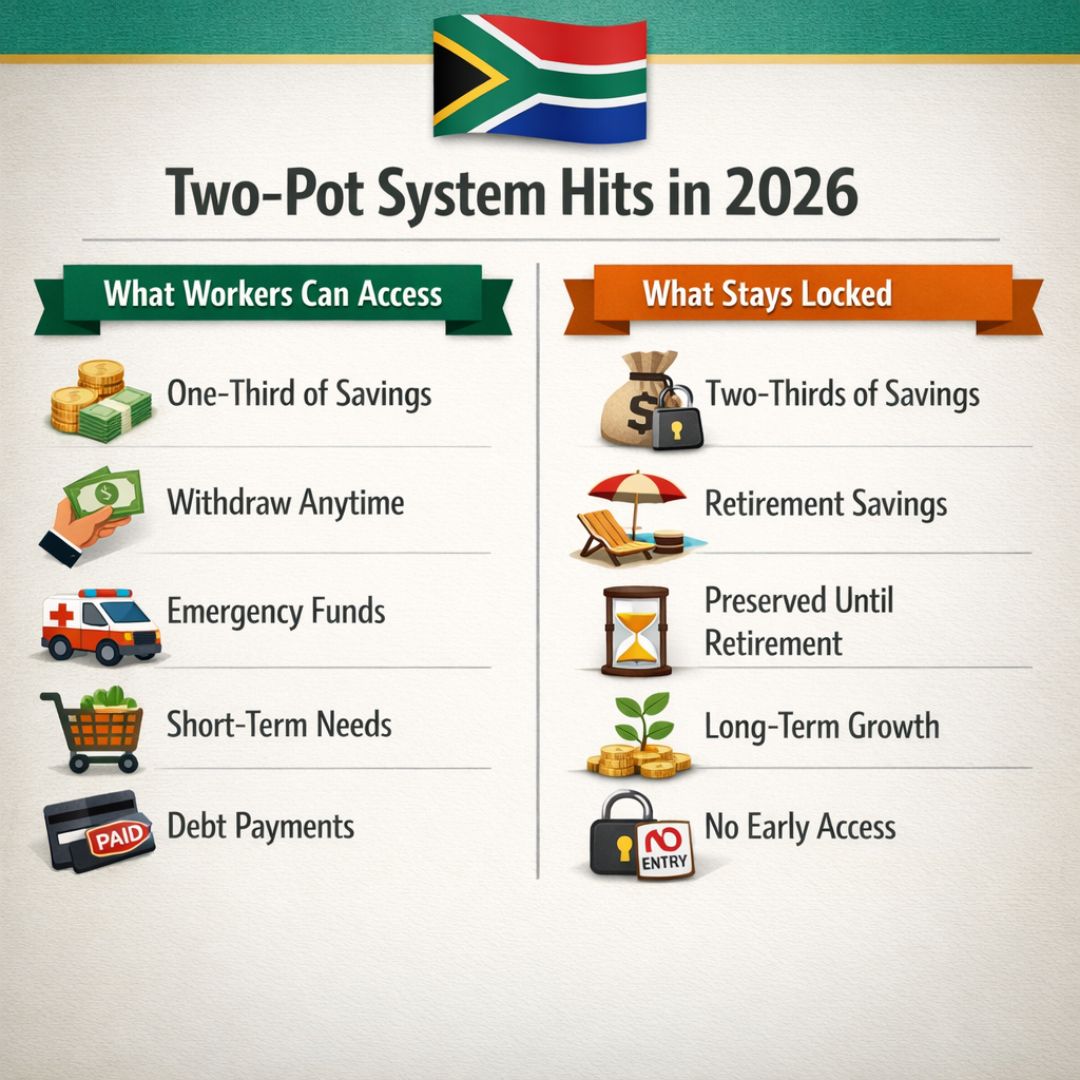

A major change is coming to South Africa’s retirement system by 2026 with the introduction of the Two-Pot Retirement System. This new system aims to balance long-term retirement security with short-term financial flexibility. The main goal is to protect workers’ retirement savings for their future while also allowing limited access to some benefits when needed. The system creates a middle ground between two important needs. On one side it safeguards retirement funds so workers have enough money when they stop working. On the other side it recognizes that people sometimes need access to their savings before retirement. This approach tries to solve both problems at once. The Two-Pot system divides retirement savings into separate portions. One portion remains locked away until retirement to ensure financial security in later years. The other portion can be accessed under certain conditions to help with immediate financial needs.

Explaining the Two-Pot Retirement Framework

Under the new structure, retirement contributions will be split into two distinct portions. One portion will remain preserved until official retirement age and cannot be accessed earlier. The second portion, known as the savings component, is designed to prevent individuals from withdrawing their full retirement balance when changing jobs. This separation helps ensure that workers retain a meaningful amount of savings to support them during their retirement years.

The Reason Behind Introducing the Two-Pot Model

The government introduced the two-pot system to address growing concerns about insufficient retirement savings among South African workers. Many individuals currently withdraw their entire pension benefits when they lose a job or face financial pressure, leaving them with little security later in life. By reserving part of the funds for future access, the system aims to strengthen long-term financial resilience while still providing limited relief during emergencies.

What It Means for Employees and Employers

While the system encourages greater financial discipline, it still allows workers to access a portion of their own savings in genuine emergency situations. This approach promotes thoughtful retirement planning without removing flexibility altogether. Employers and retirement fund administrators will need to adjust payroll processes and fund structures to align with the new regulations, placing a strong emphasis on transparency and careful administration.

Smart Speed Cameras: South Africa Starts R2,000 Fines in February 2026 and Drivers Face New Risks

Smart Speed Cameras: South Africa Starts R2,000 Fines in February 2026 and Drivers Face New Risks

Getting Ready for the 2026 Implementation

As the rollout approaches, workers are advised to understand how their retirement contributions will be divided and how tax rules may apply to any withdrawals. Financial specialists recommend accessing savings only when absolutely necessary and avoiding repeated withdrawals to protect future income. With effective implementation and informed participation, the Two-Pot Retirement System could mark a significant shift toward more secure retirement planning in South Africa.