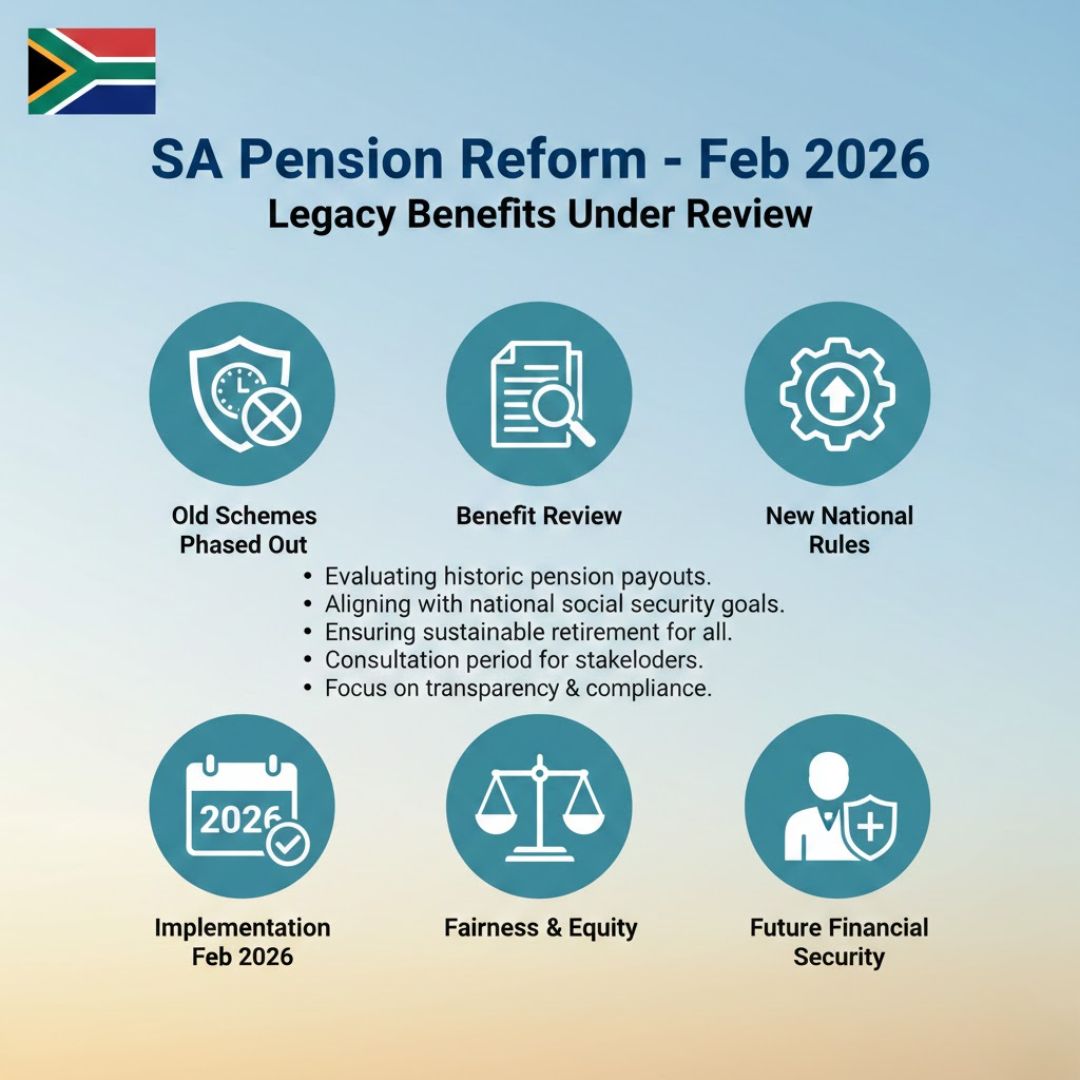

February 2026 signals a major shift in South Africa’s retirement system as older pension schemes face review and gradual replacement under new national rules. The government’s move is designed to modernise benefits, close long-standing gaps, and make retirement funding more sustainable for future generations. For public-sector workers, private employees, and retirees alike, the transition brings both reassurance and uncertainty. While legacy benefits are being reassessed rather than abruptly cancelled, the changes mark a clear step away from outdated structures toward a more consistent, transparent pension framework nationwide.

Old pension schemes exit under South Africa national pension rules

South Africa’s legacy pension schemes were created in a very different economic era, leading to unequal retirement coverage across sectors and income groups. Under the new national rules, authorities are reviewing these arrangements to address rising fiscal pressure and fragmented administration. Existing retirees are expected to retain earned entitlements, but future benefits will increasingly align with updated standards. The reform process focuses on long-term system stability, aiming to reduce dependency on state guarantees while encouraging shared responsibility. For employees still contributing, clarity around service year recognition will be a key concern during the transition.

National pension reform impact on South African workers

For South African workers, the reforms introduce both opportunity and adjustment. Moving away from older schemes encourages modern retirement planning, particularly for younger employees who value portability. Retirees and near-retirees, however, are closely watching assurances around payment security protection. Officials have stressed that pensions already in payment will not be disrupted. Over time, the new approach aims to deliver a consistent benefit structure across public and private sectors, reducing disparities and making outcomes easier to understand. This shift also supports predictable retirement income, helping households plan with greater confidence.

Goodbye to Pension Payment Confusion: Revised Welfare Payment Schedules Start Mid February 2026

Goodbye to Pension Payment Confusion: Revised Welfare Payment Schedules Start Mid February 2026

February 2026 pension rules review and transition process

The February 2026 deadline sets the foundation for how benefits are assessed and carried forward. Government departments will conduct comprehensive pension reviews to map obligations and eliminate overlaps. Contributors may be asked to confirm records to ensure accurate benefit calculation before transitions are finalised. Clear communication is expected to guide members through timelines and options, including limited transitional protections. Policymakers argue this careful rollout supports transparent rule alignment and avoids sudden shocks, allowing South Africa’s pension system to evolve without undermining trust.

What the pension overhaul means for South Africa

The move away from older pension schemes reflects South Africa’s broader push for financial sustainability and fairness. While legacy systems carry emotional and historical weight, they also pose risks in a changing economy. The new framework aims to deliver simplified pension management and clearer expectations for contributors. For individuals, staying informed and reviewing retirement plans early will be essential. If executed carefully, the reforms could provide future-focused retirement security while honouring commitments made under the old system.

| Aspect | Legacy Pension Schemes | New National Rules |

|---|---|---|

| Eligibility Basis | Length of service | Contribution-linked |

| Benefit Formula | Fixed or defined | Standardised calculation |

| State Liability | High exposure | Managed risk |

| Portability | Limited transfer | Improved portability |

| Review Cycle | Irregular updates | Scheduled reviews |

Frequently Asked Questions (FAQs)

1. Will existing pensioners in South Africa lose benefits?

No, pensions already in payment are expected to continue without sudden reductions.

Goodbye to Pension Confusion: Updated Retirement Support Rates Roll Out Nationwide February 2026

Goodbye to Pension Confusion: Updated Retirement Support Rates Roll Out Nationwide February 2026

2. When do the new pension rules start?

The national pension changes begin rolling out from February 2026.

3. Are workers required to switch immediately?

No, transitional arrangements may apply depending on employment status and scheme type.

4. Why is South Africa changing old pension schemes?

The reforms aim to improve sustainability, fairness, and long-term financial stability.