Updated Pension Rates Bring Clarity to Retirement Support

The revised pension framework aims to remove uncertainty that has frustrated beneficiaries for years. With clear payment brackets now published in advance, recipients can better plan household expenses. The update also introduces standardised rate tables, replacing inconsistent adjustments that varied across regions. Officials highlight simplified benefit calculations as a major win, reducing errors and disputes. For many seniors, the biggest relief comes from predictable monthly income, which helps stabilize budgeting amid rising food, transport, and healthcare costs.

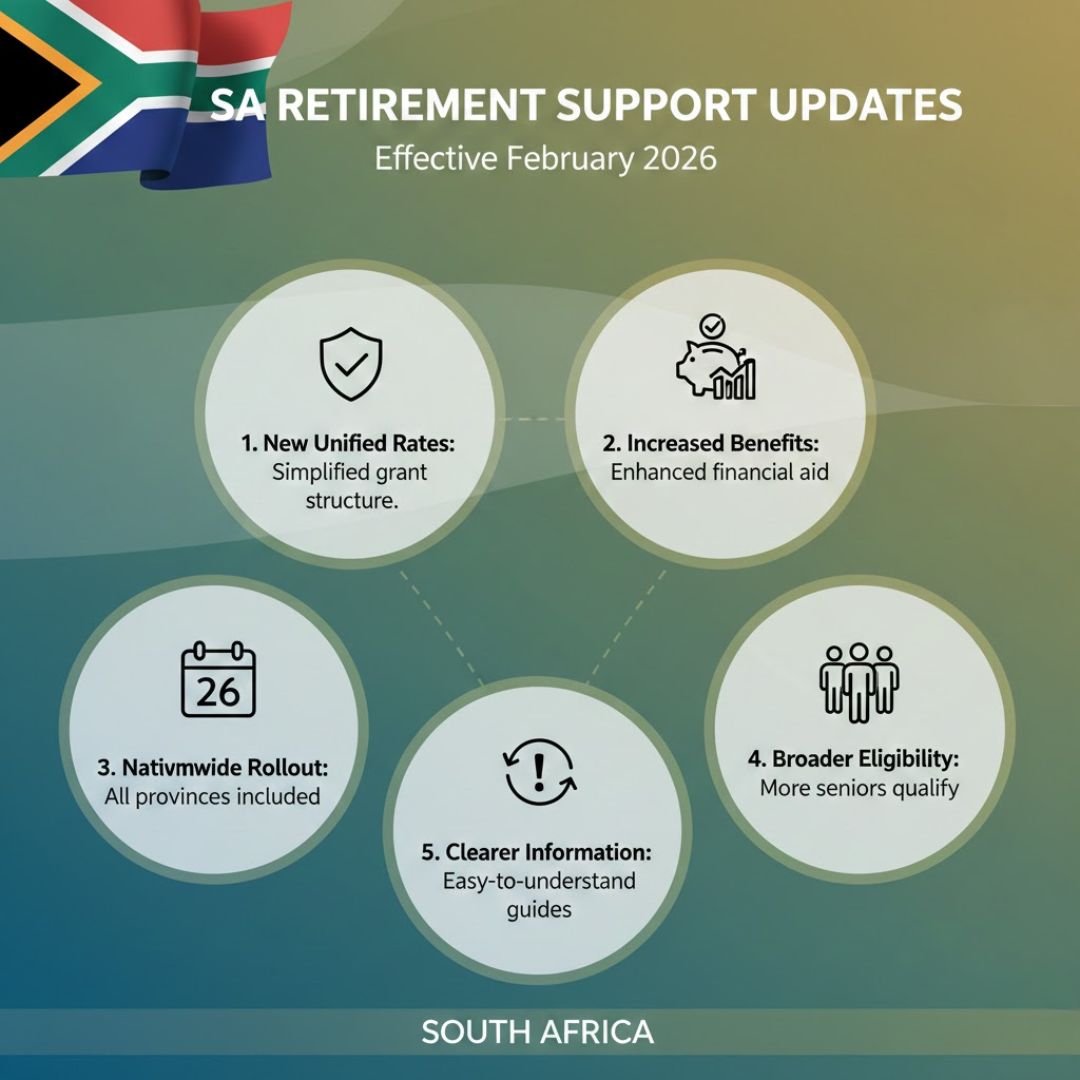

South Africa’s Retirement Support Changes Start February 2026

From February 2026, the new rates will apply automatically to most qualifying pensioners. This rollout includes automatic system updates, meaning no fresh application is required for existing beneficiaries. The government has paired this with improved data matching to ensure payments reflect accurate personal records. While the intention is fairness, some worry about short-term adjustment delays during the transition period. Still, officials maintain that nationwide rate alignment will ultimately reduce confusion and ensure equal treatment across provinces.

How New Retirement Support Rates Affect Pensioners

The impact of the updated rates goes beyond numbers on paper. For low-income seniors, better cost coverage could mean fewer trade-offs between essentials. The system also introduces clearer eligibility bands, making it easier to understand who qualifies for what level of support. Financial advisors point to long-term income stability as a positive shift, especially for households without private savings. However, pensioners are encouraged to monitor statements closely, as early transition reviews may occur during the first few months.

What the February 2026 Update Really Means

Overall, the pension update signals a more transparent approach to retirement support in South Africa. By focusing on consistent policy messaging, the government hopes to rebuild trust among older citizens. The move toward simpler rate structures should reduce misunderstandings that often led to complaints. For retirees, the key takeaway is preparation—understanding the new bands and timelines supports financial planning confidence. While no system is perfect, these changes aim to deliver fairer pension outcomes over the long term.

| Category | Before 2026 | From Feb 2026 |

|---|---|---|

| Rate Structure | Variable adjustments | Fixed published rates |

| Payment Clarity | Often unclear | Clearly defined |

| Eligibility Review | Infrequent | Regular checks |

| Application Need | Manual updates | Automatic rollout |

| Planning Ease | Low predictability | High predictability |

Frequently Asked Questions (FAQs)

1. When do the new pension rates start?

The updated retirement support rates take effect nationwide in February 2026.

SASSA February 2026 Payment Update Lists R560 and R1,250 Grants Paid on 17 February - Track Yours

SASSA February 2026 Payment Update Lists R560 and R1,250 Grants Paid on 17 February - Track Yours

2. Do current pensioners need to reapply?

No, most existing beneficiaries will be updated automatically.

3. Will payment amounts increase for everyone?

Changes depend on eligibility bands, so increases may vary.

4. Where can pensioners check the new rates?

Official government channels will publish the updated rate tables.