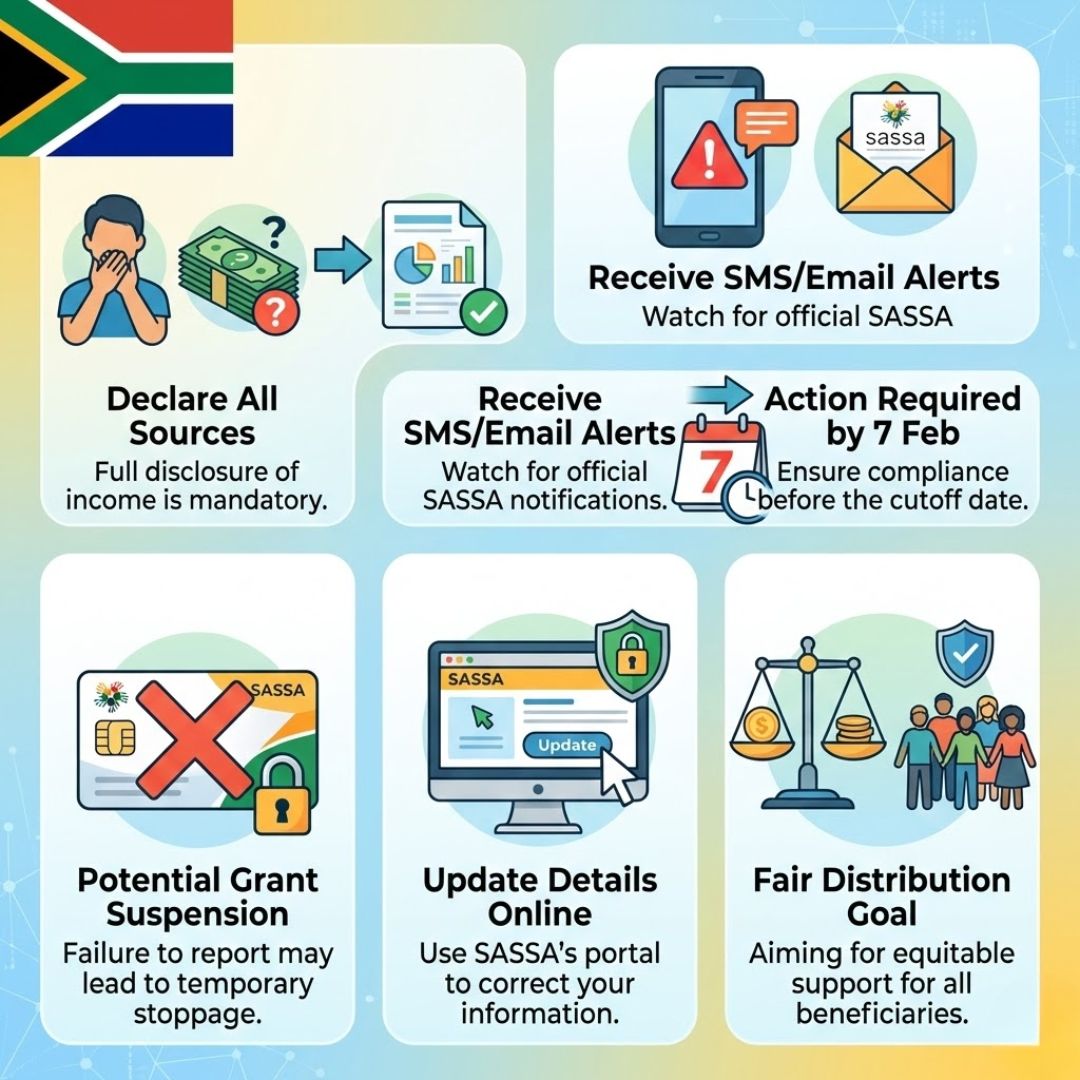

South Africa’s social grant system is facing renewed scrutiny as the South African Social Security Agency (SASSA) issues suspension alerts over unreported income. Ahead of 7 February 2026, beneficiaries across the country are being warned to review their financial disclosures or risk temporary or permanent grant suspensions. The move forms part of a broader compliance drive aimed at protecting limited public funds and ensuring only eligible individuals receive support. For many households relying on grants, these alerts serve as a critical reminder to stay transparent and up to date.

SASSA grant suspension alerts target unreported income

SASSA has intensified checks to identify cases where beneficiaries failed to declare additional earnings. Using data matching with banks and other institutions, the agency can now flag hidden income sources that were previously missed. Once detected, automated suspension alerts are sent via SMS or official letters, giving recipients a short window to respond. The goal is not to punish honest mistakes, but to correct records and prevent abuse. Still, ignoring these warnings could lead to payment interruptions or full cancellations. For many families, understanding how these alerts work is the first step to protecting their grant support.

Unreported earnings put SASSA grants at risk

Even small or irregular earnings can affect grant eligibility if not disclosed. SASSA defines income broadly, covering wages, informal work, and financial support from others. Beneficiaries often assume minor amounts do not matter, but income threshold breaches can quickly trigger reviews. The agency urges recipients to update details before deadlines to avoid grant suspension risks. With the 7 February 2026 date approaching, delays could result in temporary benefit freezes. Staying proactive and transparent helps ensure continued support while keeping the system fair for all recipients.

SASSA compliance checks ahead of 7 February 2026

The February deadline marks a key phase in SASSA’s nationwide compliance campaign. Beneficiaries who receive alerts are expected to respond promptly, either online or at local offices. Failure to act may be treated as non-compliance issues, leading to extended suspensions. SASSA has stressed that verification deadlines are firm, though appeals remain available for disputed cases. This process is designed to balance accountability with access, ensuring grants reach those who truly qualify while reducing system misuse concerns.

What this means for grant recipients

For grant recipients, these developments highlight the importance of keeping personal and financial records accurate. While the process may feel stressful, it also offers an opportunity to correct errors before harsher measures apply. Responding early can prevent long-term grant loss and reduce anxiety. SASSA’s approach reflects a shift toward data-driven oversight, which may become standard in future reviews. Understanding your obligations and acting quickly can safeguard support and reinforce trust in welfare systems that millions depend on daily.

| Grant Type | Income Disclosure Required | Risk if Undeclared | Action Needed |

|---|---|---|---|

| Older Persons Grant | Yes | Suspension | Update income details |

| Disability Grant | Yes | Review or cancellation | Submit verification |

| Child Support Grant | Yes | Temporary freeze | Confirm household income |

| SRD Grant | Yes | Immediate suspension | Respond to alert |

Frequently Asked Questions (FAQs)

1. Why is SASSA sending suspension alerts?

Alerts are sent to address cases of income that was not reported during grant applications.

Smart Speed Cameras: South Africa Starts R2,000 Fines in February 2026 and Drivers Face New Risks

Smart Speed Cameras: South Africa Starts R2,000 Fines in February 2026 and Drivers Face New Risks

2. What counts as unreported income?

Any wages, informal earnings, or financial support not declared to SASSA counts.

3. Can a suspended grant be reinstated?

Yes, grants may be reinstated once correct information is verified.

4. What happens if I ignore the alert?

Ignoring alerts may lead to extended suspension or permanent cancellation.