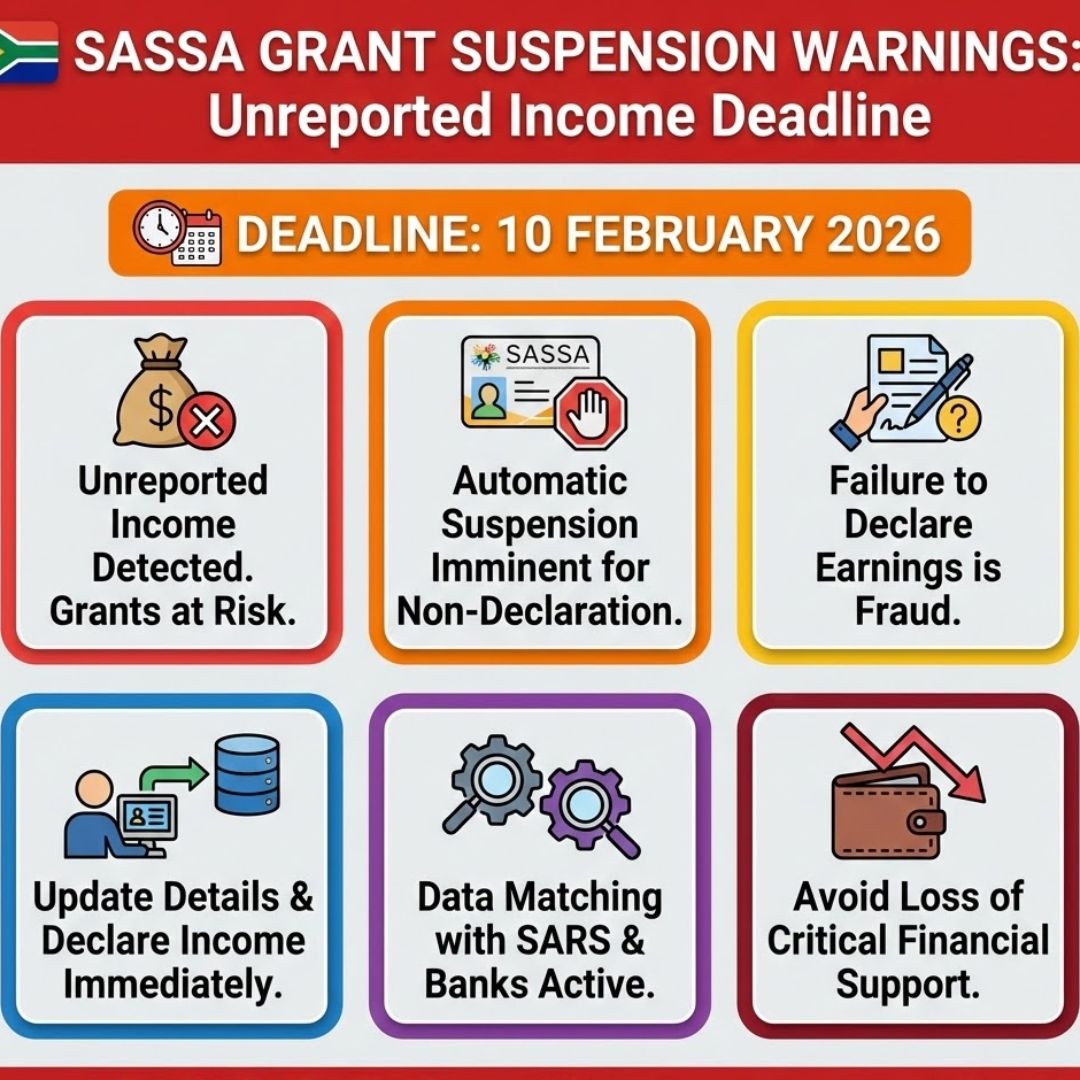

As South Africa tightens oversight of its social welfare system, beneficiaries are being warned that undeclared earnings could soon lead to serious consequences. The South African Social Security Agency (SASSA) has issued firm grant suspension warnings ahead of 10 February 2026, targeting individuals who fail to report additional income. This move forms part of a broader compliance drive aimed at protecting public funds while ensuring support reaches those who truly qualify. For millions of grant recipients nationwide, the message is clear: transparency is no longer optional.

SASSA grant suspension warnings target unreported income

SASSA has made it clear that beneficiaries who hide earnings risk immediate action, including temporary or permanent loss of support. Using updated data-matching systems, the agency can now cross-check bank records, employment data, and government databases more efficiently. This means income disclosure rules are being enforced more strictly than before. Officials say the goal is not punishment but fairness, ensuring grants reach vulnerable households. With automatic data checks becoming routine, beneficiaries are encouraged to update records promptly. Ignoring these notices could trigger grant suspension notices, disrupting monthly payments many families depend on.

Why SASSA is tightening grant compliance before February 2026

The February 2026 deadline is not random; it aligns with annual system audits and fiscal planning cycles. SASSA faces mounting pressure to curb misuse while sustaining support for eligible citizens. Rising application volumes and limited budgets have pushed the agency to act decisively. Through fraud prevention drive, authorities aim to restore trust in the welfare system. Officials stress that public funds protection benefits everyone, especially those relying solely on grants. By addressing discrepancies early, SASSA hopes to avoid mass disruptions later and ensure smoother payment system integrity.

How beneficiaries can avoid SASSA grant suspension

Staying compliant is simpler than many fear, provided beneficiaries act early. SASSA advises recipients to declare any form of income, even temporary or informal work. Updating details can be done online, at service offices, or through designated community points. Keeping documentation ready supports beneficiary verification process and reduces delays. Regularly checking notifications helps prevent surprises, while honest reporting ensures continued grant eligibility. Ultimately, cooperation protects households from sudden income loss and supports **fair grant distribution across the system.

What this means for South Africa’s social grants system

These warnings signal a shift toward stricter accountability in social assistance. While some fear exclusions, others see a necessary reform to keep grants sustainable. Transparent reporting strengthens confidence that aid reaches those most in need. If implemented carefully, the approach could balance enforcement with compassion. For beneficiaries, the takeaway is awareness and action. Understanding requirements and responding early supports long-term system sustainability while maintaining social welfare trust. As February approaches, proactive engagement may determine whether support continues uninterrupted.

| Grant Type | Income Reporting Required | Risk if Not Reported |

|---|---|---|

| Old Age Grant | Yes | Temporary suspension |

| Disability Grant | Yes | Payment review |

| Child Support Grant | Household income | Grant cancellation |

| SRD Grant | Monthly checks | Immediate suspension |

Frequently Asked Questions (FAQs)

1. What income must be reported to SASSA?

Any regular or temporary earnings, including informal work, should be declared.

Smart Speed Cameras: South Africa Starts R2,000 Fines in February 2026 and Drivers Face New Risks

Smart Speed Cameras: South Africa Starts R2,000 Fines in February 2026 and Drivers Face New Risks

2. When is the deadline to update income details?

Beneficiaries should update records before 10 February 2026.

3. Will all undeclared income lead to suspension?

Cases are reviewed individually, but non-disclosure increases suspension risk.

4. How can beneficiaries update their information?

Updates can be made online, at SASSA offices, or through approved service points.